What most people don’t foresee, however, is that this is often only a temporary move. After a few years, many people realize they’re not in a position to thrive as they age. If you’re in downsizing mode, you must think beyond the desires of more freedom and less maintenance. It’s important to conduct a cost-benefit analysis and quality of life assessment. Aside from thinking about what you need now in a home, it’s crucial to consider what support you’ll need as you age and how much that will cost you.

After all, our needs change as we get older, and we’re often faced with physical and sometimes cognitive limitations. If our living environment doesn’t address that, we may be faced with some tough choices a little later in life than we might prefer. Is a condo or town home really the right move—or just an in-between?

The reality of the situation is this: The only option that provides all levels of senior living, and actually addresses the physical limitations we’ll face as we age, is the continuing care retirement community (CCRC).

Let’s examine this claim from two perspectives: lifestyle and financial.

CCRCs offer everything that other living options provide, but then take it a (large) step further. The advantages they offer over other living options can be summed up in this chart:

The sheer number and quality of benefits over other lifestyle options is staggering. From engaging residents mentally and physically through dedicated classes and programs, to taking regular housekeeping and laundry chores off the to-do list and providing 24-hour security on campus and health emergency monitoring, CCRCs are the clear winner in providing the ideal lifestyle. You can still downsize the dwelling while simultaneously upsizing the services.

Having all those services in one location, in addition to providing peace of mind, also provides an enormous financial benefit – which segues into an important consideration when deciding where to move.

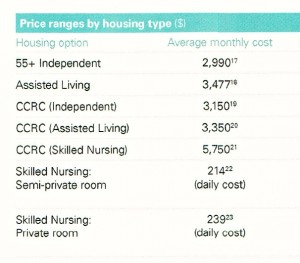

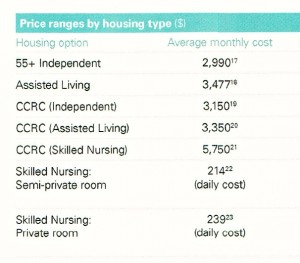

Surely all the services in the chart above come with a cost. While in fact they do, the number isn’t as high as what you might think when compared to other lifestyle options.

If you currently own or rent your home, for example, you have the fixed costs of a mortgage or rent payments, property taxes and home insurance, and you may also have association fees. Then you have the costs of utilities such as water, electric, gas and cable (and the list goes on). In addition, there is the upkeep of the grounds such as lawn service, snow removal and landscaping.

Even if you’re not considering a condo, but rather a 55+ independent living community, keep in mind that you will not receive all levels of care in one location. A CCRC is the only senior housing option that provides all levels of care, from fully independent to assisted living to short-term rehabilitation and, when necessary, hospice care.

But how do those costs compare? A chart provided by Legg Mason, a financial services company, demonstrates the cost differentials between community types nationwide.

A resident at Judson’s South Franklin Circle CCRC realized the benefits of having all these care levels in one location when he fell and broke his femur two years ago. After one week in the hospital, he was able to move back to his community for rehab, receiving quality care while staying close to his apartment home and his wife.

Entry Fees: Most CCRCs require upfront entry fees. However, this is not as intimidating as it sounds. These entry fees are often largely refundable depending on how long the resident lives in the community. Judson’s entry fees, for example, come with a 75% refundable option where the resident receives 75% of their initial deposit back whenever the contract ends. When you begin looking into different communities, ask about these up-front costs and find out if they’re refundable.

Monthly Fees: As broken down in the two charts above, you can see the comparative advantages of choosing a CCRC over a living option like a condo or 55+ independent community. Monthly fees cover most, if not all, of the services and amenities offered by a CCRC. From landscaping to community programming to fitness centers – your dollar goes much further in a CCRC than it will with any other living option available.

Healthcare Services (included in monthly fees): Some of these services are included in your monthly fee, and depending on the CCRC you choose, it’s important to find out exactly what medical services are available and included. Generally, potential care needs are built into contract pricing that allow for discounts when you first move into a CCRC, but be sure to ask for a list of those general care services and get details on the continuum of care at the community.

Lifestyle (included in monthly fees): How do you want to spend your time once you move? Will you seek out lifelong learning opportunities, take a class, learn to paint, join a book club, stay active by exercising? As part of the monthly fee, CCRCs can offer these amenities in a supportive environment where you can engage with other residents and continue participating in the activities you enjoy as you age.

But not all continuing care retirement communities are created equal. It’s important to get as much information as possible up front to make sure you thoroughly understand the associated costs.

America is getting older. And some people might feel like it’s too soon to move into a CCRC. The fact is that it’s never too soon:

The lifestyle you desire is available in a continuing care retirement community. Services and amenities are already in place, and the financial gain from just one transition to a CCRC with built-in medical, wellness, programming and a la carte services provides the turnkey experience that so many older adults are seeking at this stage in life.

For more information about the benefits of moving to a CCRC, please call (216) 791-2004.